Protecting Your Investment

We insure both homeowners and lenders in real estate purchase closing transactions.

What is title insurance and why is it important? Title insurance protects real estate owners and lenders against any property loss or damage they might experience from defects in title to the property. Lender Title Policy is required in transactions that involve a mortgage loan. The policy protects the mortgage lender for the loan amount and their financial interest. A homeowner should purchase an Owner Title Policy to protect their own financial interest. Each policy has its own coverage, terms, and conditions; however, title insurance is the way to protect from financial loss and associated legal expenses should there be a defect in title.

Stability Title’s behind-the-scenes approach gives you the needed assurance of your title in the financial transaction. We also partner with a national company to facilitate the real estate escrow and closing of your new home. Together, we deliver best-in-class service for peace-of-mind.

Dedicated Service

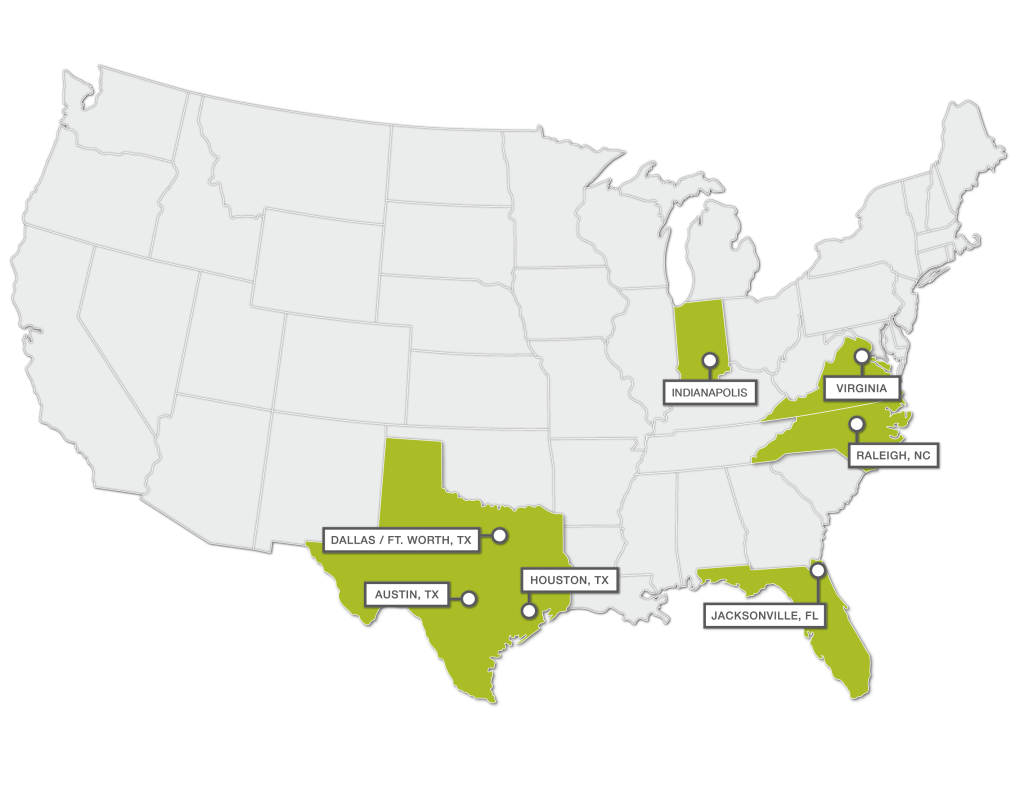

Our business started 28 years ago in Dallas, Texas. Our longstanding service is remarkable and we take pride in our history. Today, we are known as Stability Title Agency and have expanded our geographic footprint beyond Texas. We are proud members of the Texas Land Title Association and the American Land Title Association. We serve the following markets:

- Dallas, Texas

- Houston, Texas

- Austin, Texas

- Indianapolis, Indiana

- Jacksonville, Florida

- Raleigh, North Carolina

- Virginia